Ivane Javakhishvili Tbilisi State University

Paata Gugushvili Institute of Economics International Scientific

SPECIAL TAX REGIME IN GEORGIA AND ITS EFFECT ON SMALL BUSINESS DEVELOPMENT

Annotation. The development of small and medium-sized businesses in Georgia plays an important role in improving the difficult socio-economic situation, overcoming poverty and unemployment. Small and medium enterprises play an important role in the development of the country's economy, they make a significant contribution in ensuring sustainable economic growth and can be considered the cornerstone of any country's economy. Reforms are being implemented for the development of small and medium businesses, whose success is preceded by step-by-step monitoring and analysis of the results obtained.

Keywords: Small and medium business, Special taxation regime

Introduction

Special tax regimes apply under the Tax Code of Georgia:

a) Individuals with micro business status;

b) For entrepreneurial individuals with small business status;

c) For persons with the status of a fixed taxpayer.

From July 1, 2018, for the promotion and development of micro and small businesses came into force a new preferential tax regime. As the authors of the reform suggested, the large-scale tax change should have affected up to 120,000 entrepreneurial individuals. This reform, on the one hand, imposes a minimum tax burden (1%) on small businesses, on the other hand, simplified tax accounting ensures that tax administration costs are minimized for entrepreneurs. As a result of the reform, it is expected that the share of small businesses in GDP will increase significantly. In addition, the new reform is expected to provide greater transparency to the tax sector. That will help small businesses better access to financial resources. The benefits established by the special tax regime is an important incentive for further rapid development of small businesses in Georgia.

* * *

The main motive of the Ministry of Finance is to encourage entrepreneurs in the future, to get small business status and start an economic activity, become even more competitive, expand their business, which is a very important precondition for achieving the type of economic growth that will significantly affect each citizen. Entrepreneurs should spend as little time as possible in dealing with the tax authorities and their efforts should be entirely focused on their economic activities. Under this reform, small entrepreneurs will be exempted from conducting additional accounting operations. The reform implemented by the Government of Georgia aims to employ as many people as possible, creating preconditions for the development of medium and small business, economic growth will be an irreversible process and comprehensive. According to the change in the tax legislation, the status of a small business can be granted to entrepreneurial individuals, whose total income for one calendar year will be up to 500,000 GEL instead of the previous 100,000 GEL. The taxable income of a person with the status of a small business from the entry into force of the tax change is taxed at a rate of 1%, instead of 5%. It should be noted that despite the excess of GEL 500,000, the person retains the status of a small business for 2 calendar years. Under the amendment, the termination of small business status will no longer be based on the fact that an individual entrepreneur is registered as a value added tax payer. Also a person with small business status does not pay current payments and makes a declaration through a simple monthly declaration form. Small business status is granted to an entrepreneur natural person. Entrepreneurial individual registration is carried out by the Revenue Service (for example, in the case of artistic activities) and if a person is considered an individual entrepreneur in accordance with the Law on Entrepreneurs due to his / her activities, before being granted the status of a small business, he / she is obliged to register as an individual entrepreneur. Registration as an individual entrepreneur is usually carried out by the National Agency of Public Registry of the Ministry of Justice of Georgia. In order to be granted the status of a small business, an individual entrepreneur must apply to the tax authority. Small business status is granted to a person from the date indicated in the application. In case of revocation of the status of a small business, an individual entrepreneur has the right to apply to the tax authority in the same year, with a request to re-grant the status, and receive the status again.

Almost two years have passed since the introduction of the new tax regime. In order to determine the impact of this reform on the performance of small businesses during this period, we found 2 main types of information from the National Statistics Office of Georgia. ”Turnover by size and period of enterprises” and ”number of employees according to the size and period of enterprises”. We conducted dynamic and structural analysis of data from the last five years. This result allows us to draw the appropriate conclusions about the achievement of the reform goal.

Table 1: Turnover by Enterprise Size and Period

|

|

Total |

Large |

Medium |

Small |

|

2015 |

56984.8 |

24671.6 |

13294.6 |

19018.7 |

|

2016 |

64081.8 |

28256.3 |

14039.1 |

21786.4 |

|

2017 |

71740.1 |

32201.1 |

16568.3 |

22970.7 |

|

2018 |

86625.1 |

42902.7 |

18543.2 |

25179.1 |

|

2019 |

109 024,3 |

60 504,6 |

21 065,5 |

27 454, |

|

2020[1] |

128222,5403 |

75715,7387 |

23634,472 |

30092,747 |

|

Medium growth rate |

117.6% |

125.1% |

112,2% |

109,6% |

Source: National Statistics Office of Georgia

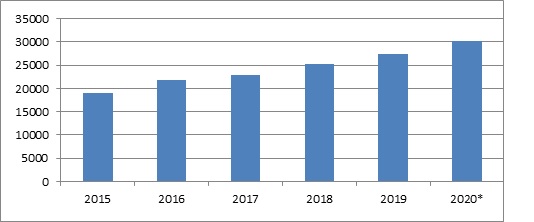

As the authors of the reform suggested, Tax changes should have increased turnover in small businesses, as well as increased the number of employees and the share of small businesses in GDP. As can be seen from the given information, the assumption about the dynamics of turnover was justified:

Chart 1: Small Business Turnover Dynamics

Source: National Statistics Office of Georgia

If we take the preliminary data of the National Statistics Office for the I - III quarters of 2020 and forecast the data for the IV quarter based on the analysis of quarterly data of previous years (2017-19), then the forecast business revenues for the current year are as follows:

Table 2: Turnover for 2020 by size and period of enterprises

|

Total |

Large |

Medium |

Small |

|

|

Iquarter |

26 015,20 |

15 597,90 |

4 336,30 |

6 081,00 |

|

IIquarter |

22 314,70 |

13 117,20 |

3 975,70 |

5 221,90 |

|

IIIკ quarter |

29 226,30 |

16 687,40 |

5 181,40 |

7 357,60 |

|

IVquarter[2] |

38245,57 |

21968,50 |

7312,05 |

9399,33 |

|

Total |

115 801,77 |

67 371,00 |

20 805,45 |

28 059,83 |

|

Annual average growth rate |

112.5% |

118.2% |

107.7% |

106.7% |

Source: National Statistics Office of Georgia

If we compare the growth rate given in Table 1, the growth rate of the quarterly indicators of 2020 is 3-7% lower than the corresponding indicator of the previous years. One of the main reasons for this is the restrictions imposed on the business activities invited by Covid-19. As for the increase in the share of small businesses in the total turnover, unfortunately, the expectations were not met here.

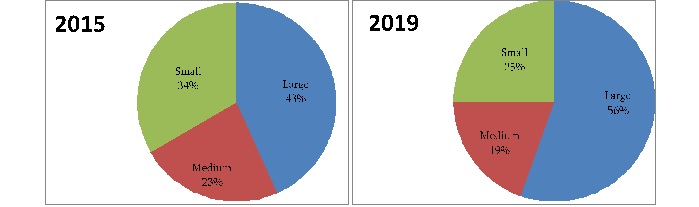

As the data analysis showed, by 2015, the share of small businesses in total turnover was 34%. Before the start of the reform, in 2018, the share of small businesses in total turnover was reduced to 29%.

The data have not improved since the implementation of the reform, on the contrary, the downward trend has been maintained and by 2019 there is a 4% decrease compared to the previous year. There is also a downward trend in the share of the average business in total turnover - in 2019 it decreased by 4% compared to 2015.

Figure 3: Share of total turnover by enterprise size

As for employment figures, the data of the National Statistics Office are as follows:

Table 3: Number of employees by size and period of enterprises

|

|

Total (Male) |

Large |

Medium |

Small |

|

2015 |

626739 |

198586 |

137171 |

290982 |

|

2016 |

666790 |

217800 |

142447 |

306543 |

|

2017 |

708165 |

233589 |

145463 |

329112 |

|

2018 |

734215 |

243318 |

160095 |

330803 |

|

2019 |

756 852 |

265 184 |

152 516 |

339 152 |

Source: National Statistics Office of Georgia

As can be seen from the data in the table, the number of employees in enterprises of all sizes was growing from 2015 to 2018, but in 2019, compared to 2018, a downward trend was observed. However, it should be noted, that the 2019 data are preliminary, which the National Statistics Office will clarify later, and the trend may also change.

Table 4: Employee dynamics by 2020 by enterprise size

|

|

Total (Male) |

% Growth |

Medium |

% Growth |

Small |

% Growth |

|||

|

2019 |

2020 |

2019 |

2020 |

2019 |

2020 |

||||

|

Iq |

663804 |

684372 |

103,0985 |

136435 |

141859 |

103,9755 |

282250 |

269354 |

95,431 |

|

IIq |

687874 |

631814 |

91,85025 |

147397 |

142030 |

96,35881 |

289707 |

228252 |

78,78719 |

|

IIIq |

695994 |

645571 |

92,75525 |

154406 |

146855 |

95,10965 |

289033 |

237418 |

82,14218 |

Source: National Statistics Office of Georgia

Here, too, one of the main reasons for the unfavorable growth rate of employees can be considered the restrictions imposed on business activities induced by Covid - 19.

As some research show, awareness of the benefits of tax breaks and the rules for their use is quite low among business people. [Baramidze C., Kharkhelauri K. 2020. 5].

The information received from the Revenue Service on the number of registered taxpayers with special tax status in terms of years is as follows:

Table 5: Information on taxpayers with special tax regime status

|

Period |

Number of taxpayers |

||

|

Fixed tax payer |

Micro Business Status |

Small Business Status |

|

|

2016 |

5 771 |

44 813 |

52 951 |

|

2017 |

6 150 |

48 426 |

60 754 |

|

2018 |

6 746 |

52 237 |

73 048 |

|

2019 |

7 323 |

61 550 |

91 627 |

|

2020_01-2020_08 |

6 994 |

64 075 |

98 907 |

Source: Revenue Service of Georgia

It should be noted that the information is prepared according to the persons who had the current status of a small / micro business for at least one day during the relevant tax period and Persons who have accrued a fixed tax at least once in the period from December 31, 2010 to 2016_02-2020_08 take part in counting the number of fixed taxpayers N 999 “On the use of special tax regimes” In accordance with Article 4 of the Order.

Conclusion

As can be seen from the table, the dynamics of those wishing to enjoy the benefits of this regime is growing, which gives reason to believe that the business activities of this segment will increase and will play an important role in overcoming the consequences of the current economic crisis.

We hope that the relevant government and business structures will intensify their work on the awareness of these tax benefits, which will lead to an increase in the number of officially registered entities benefiting from the special tax regime. This in turn leads to the positive results that the authors of the reform had planned and achieved an increase in the share of individuals with the status of micro, small and fixed taxpayers in the economic development of the country.

References:

- Baramidze C., Kharkhelauri K. 2020. Special Tax Regime in Georgia and the Effect of its Operation. DOI: 10.13140/RG.2.2.25055.89769

- commersant 2018-07-02, Editorial article https://commersant.ge/ge/post/mcire-biznesi-1- ivlisidan-nacvlad-5-isa-1-it-daibegreba

- National Statistics Office of Georgia http://pc-axis.geostat.ge/PXweb/pxweb/ka/ Database/Database Business% 20StatisticsTurnover/?r xid=60943dd6-d6da-4cfc-bc19-15190adb8136

- Kharkhelauri kh., Kajaia T. 2019 Effectiveness Of State Programs For The Promotion Of Small And Medium Businesses. Economics and Finance N 3, pp 65-77

- https://docs.wixstatic.com/ugd/1ee679_f10f3ff3a0eb44c4a44df5d21a18b298.pdf DOI: 10.13140/RG.2.2.27408.64005

- Tax Code of Georgia, Chapter XII Article 83. https://matsne.gov.ge/ka/document/view/1043717

[1] 2020 The year rate is forecast and calculated taking into account the average growth rate

[2] Forecast